Structured and unstructured data in finance: a practical guide for building AI agents

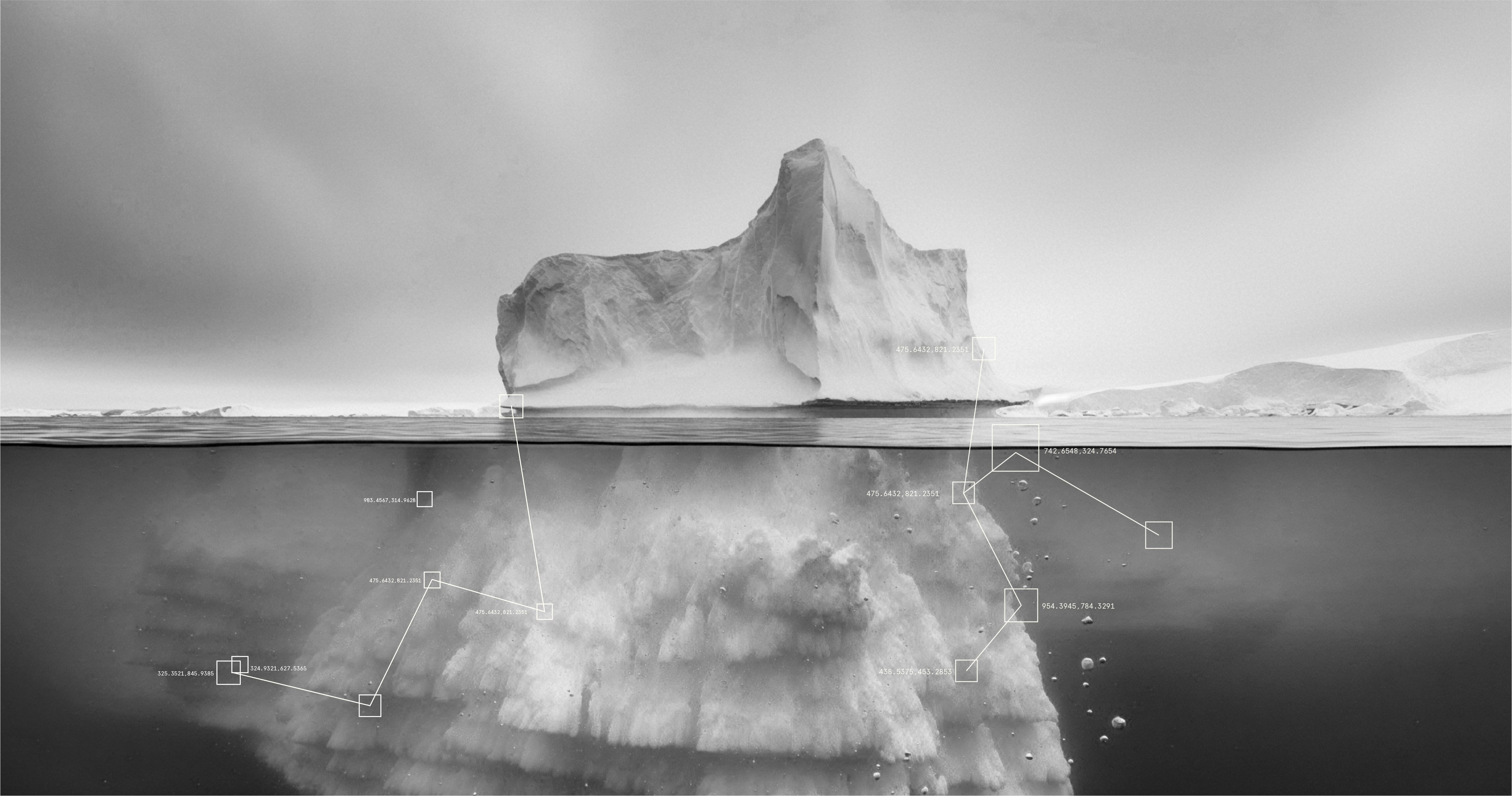

AI agents are rapidly reshaping the financial industry - from automated research analysts to compliance copilots, portfolio intelligence systems, real-time market monitors, and internal knowledge assistants. But no matter how advanced an AI model or agentic workflow becomes, its performance is ultimately limited by one thing:

Data.

Finance is uniquely data-dense. Markets move on filings, corporate communications, macroeconomic signals, research insights, sentiment flows, and millions of real-time news events each month. AI agents must be able to reason across both structured and unstructured data at scale, and that requires a unified data layer built for AI.

The key to building these systems lies in understanding how structured and unstructured data complement each other.

The data dichotomy in finance

Structured data: The numerical backbone

Structured data follows a clear schema and lives in tables and databases. It's the foundation of quantitative finance: financial statements, consensus estimates, company fundamentals, ESG metrics, macro indicators, and historical price data.

Core strengths:

- Enables precise calculations and reproducible analysis

- Powers time-series forecasting and factor models

- Supports backtesting and quantitative screens

- Provides ground truth for benchmarking

At Bigdata, we cover: Over 1M fundamental data points spanning 30+ years, plus structured alternative data including ESG scores, job trends, supply chain intelligence, and sentiment signals.

Unstructured data: The contextual layer

Unstructured data captures what humans read to understand markets: news articles, regulatory filings, earnings transcripts, press releases, podcasts, and expert commentary. This is where narrative, sentiment, and forward-looking signals live.

Core strengths:

- Reveals qualitative insights that numbers can't capture

- Detects emerging risks and anomalies before they appear in financials

- Tracks management tone, strategy shifts, and market sentiment

- Enables real-time event monitoring and thematic research

At Bigdata, we cover: 10M+ monthly news documents with 5 years of rolling history, 200+ premium sources including Benzinga, MT Newswires, Risk.net, Al Jazeera, & more, filings from 20k+ global companies, press releases from 25k+ companies, transcribed earnings calls, 3.5k+ finance podcasts, and licensed expert interviews.

Why the best AI agents are multimodal

Financial decision-making is inherently multimodal. Consider these scenarios where both data types are essential:

Earnings analysis

An AI agent monitoring quarterly results needs revenue figures and margin trends (structured), but also must parse management's tone during the call, decode guidance language, and extract insights from Q&A discussions (unstructured). The numbers tell you what happened; the narrative tells you what it means.

Market surveillance

Price movements and factor exposures (structured) only become actionable when combined with breaking news, geopolitical developments, and regulatory updates (unstructured). A 5% drop means something different if it's accompanied by a fraud allegation versus a sector-wide selloff.

Risk management

Leverage ratios and historical volatilities (structured) provide quantitative risk metrics, but they don't capture litigation exposure disclosed in 10-Ks or reputational risks emerging in press coverage (unstructured). Comprehensive risk assessment requires both.

Thematic research

Identifying investment themes requires tracking sector metrics and KPIs (structured) alongside expert interviews, industry commentary, and macroeconomic narratives (unstructured). The best insights emerge at the intersection of quantitative patterns and qualitative understanding.

The architectural imperative

Modern agentic workflows need systems that can:

- Ingest heterogeneous data types without manual ETL for each source

- Understand documents through NLP while preserving semantic and temporal context

- Resolve entities across formats (linking "Apple," "AAPL," and "the Cupertino-based company")

- Maintain temporal alignment between quarterly financials and real-time news

- Reason across modalities to produce coherent, well-grounded outputs

This is why unified data platforms matter. When both structured and unstructured datasets are organized in LLM-friendly formats with consistent entity resolution and licensing, developers can focus on agent capabilities rather than data plumbing.

Common implementation challenges

1. Format heterogeneity

Filings use dense legal language, press releases follow PR conventions, podcasts contain conversational speech, and fundamental datasets arrive as structured tables. Each requires different parsing strategies.

2. Temporal misalignment

Structured data often arrives quarterly while unstructured data flows continuously. Synchronizing these timelines for coherent analysis is non-trivial.

3. Entity disambiguation

Text references like "the company," "management," or ticker symbols must reliably map to canonical entities in structured databases—across languages, filing types, and corporate structure changes.

4. Licensing complexity

Enterprise workflows require clear data provenance, usage rights, and redistribution permissions. Ad-hoc data sourcing creates legal and compliance risk.

5. Latency constraints

Use cases like risk monitoring and anomaly detection demand sub-minute latency, which requires both fresh data and optimized delivery infrastructure.

AI Workflows by input type

Automated research

- Structured inputs: Historical KPIs, valuation multiples

- Unstructured inputs: News, earnings calls, expert interviews

- Key integration point: Connecting quantitative screens to qualitative catalysts

Surveillance & compliance

- Structured inputs: Transaction logs, trade alerts

- Unstructured inputs: Filings, regulatory updates

- Key integration point: Matching numeric anomalies to disclosure events

Portfolio intelligence

- Structured inputs: Risk factors, returns, exposures

- Unstructured inputs: Macro commentary, corporate communications

- Key integration point: Explaining portfolio behavior through narrative context

Credit analysis

- Structured inputs: Financial statements, leverage ratios

- Unstructured inputs: Management commentary, industry sentiment

- Key integration point: Combining credit metrics with forward-looking signals

Thematic analysis

- Structured inputs: Sector metrics, growth rates

- Unstructured inputs: Podcasts, interviews, long-form reports

- Key integration point: Identifying emerging themes from both data and discourse

How developers build with Bigdata.com

The Bigdata store provides a unified platform for premium financial data with full attribution, extended shelf-life, and enterprise-grade compliance:

Public & premium news: Event detection and sentiment analysis with 200+ licensed sources.

Filings: Deep narrative extraction from 10-Ks, 10-Qs, 8-Ks, and global regulatory documents.

Corporate communications: Structured access to press releases and company announcements

Fundamentals: Numeric grounding with 30+ years of historical depth

Podcasts & expert interviews: Qualitative insights from 3.5k+ finance shows and licensed specialist interviews

Alternative data: ESG scores, job trends, supply chain intelligence, and sentiment signals

The platform's value proposition is engineering efficiency: multimodal data is pre-normalized, entity-resolved, and delivered through consistent APIs, which dramatically reduces the integration work needed to build production-grade agents.

So what's next?

The next generation of financial AI won't choose between structured and unstructured data - it will seamlessly integrate both. As language models become more capable and agentic workflows more sophisticated, the bottleneck shifts from model performance to data infrastructure.

Key principles for builders:

- Design for multimodality from day one. Single-modality systems hit capability ceilings Make quickly.

- Prioritize data quality over volume. More data only helps if it's accurate, timely, and properly licensed.

- Invest in entity resolution. It's unglamorous infrastructure work that pays compounding returns.

- Build for interpretability. Financial AI must explain its reasoning and cite its sources.

- Plan for scale. Data volumes and latency requirements will only increase.

The datasets provided through platforms like Bigdata represent an approach to consolidating these data types for AI systems built around research, monitoring, and decision-support. As financial information continues to fragment across sources and formats, having a unified data layer becomes less of a convenience and more of a competitive necessity.

The question isn't whether your AI agents need both structured and unstructured data. The question is how efficiently you can provide it to them.