Connect to Bigdata trusted intelligence through our upgraded MCP

AI adoption in finance stalls at the same two barriers: generic LLMs hallucinate financial data, and fixing it requires months of custom API integration. Ask ChatGPT about credit exposure or earnings surprises and watch it fabricate numbers with zero source attribution. Recognize the gap and try connecting premium data in your own solution? Prepare for engineering sprints, bottlenecks, and deployment timelines that outlast the business need.

Model Context Protocol (MCP) eliminates both problems. And with our upgraded MCP integration, Bigdata.com now brings grounded financial intelligence to the platforms you are already using, with zero code integration.

What is MCP?

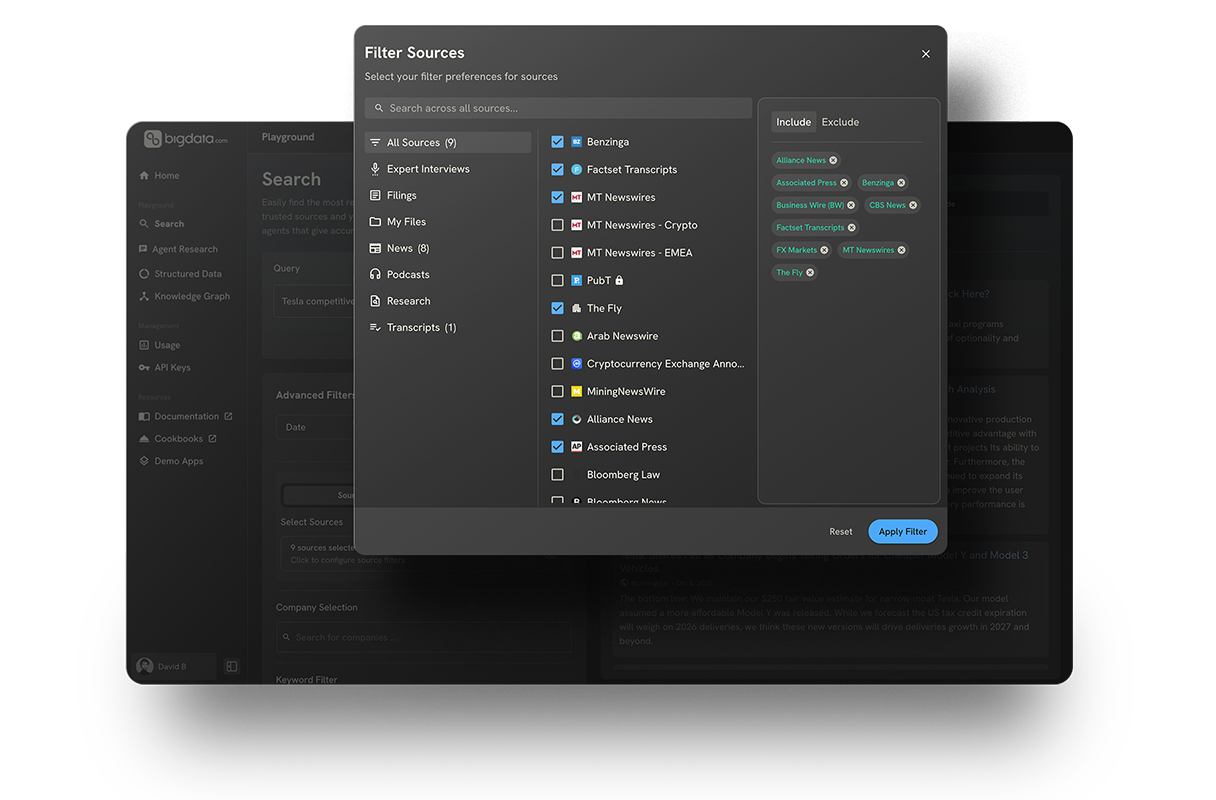

In short, MCP is an open standard that allows AI agents - such as Claude, ChatGPT, Copilot and other proprietary agentic platforms - to connect directly to external data sources without custom development. Instead of weeks-long API projects with integration, MCP enables integration with zero code. Get all of our financial intelligence, based on premium data, without any friction.

For financial services, this is transformational. MCP turns generic LLMs into specialized intelligence platforms grounded in real-time, structured, verifiable, audit-ready data with customization tools all in your hands.

Bringing grounded intelligence to where teams already work

Most MCP integrations bolt basic data retrieval onto an LLM. Bigdata.com delivers something fundamentally different: we're bringing a complete financial intelligence layer to the platforms teams already use - no platform switching, no migration projects, no forcing analysts to learn new tools.

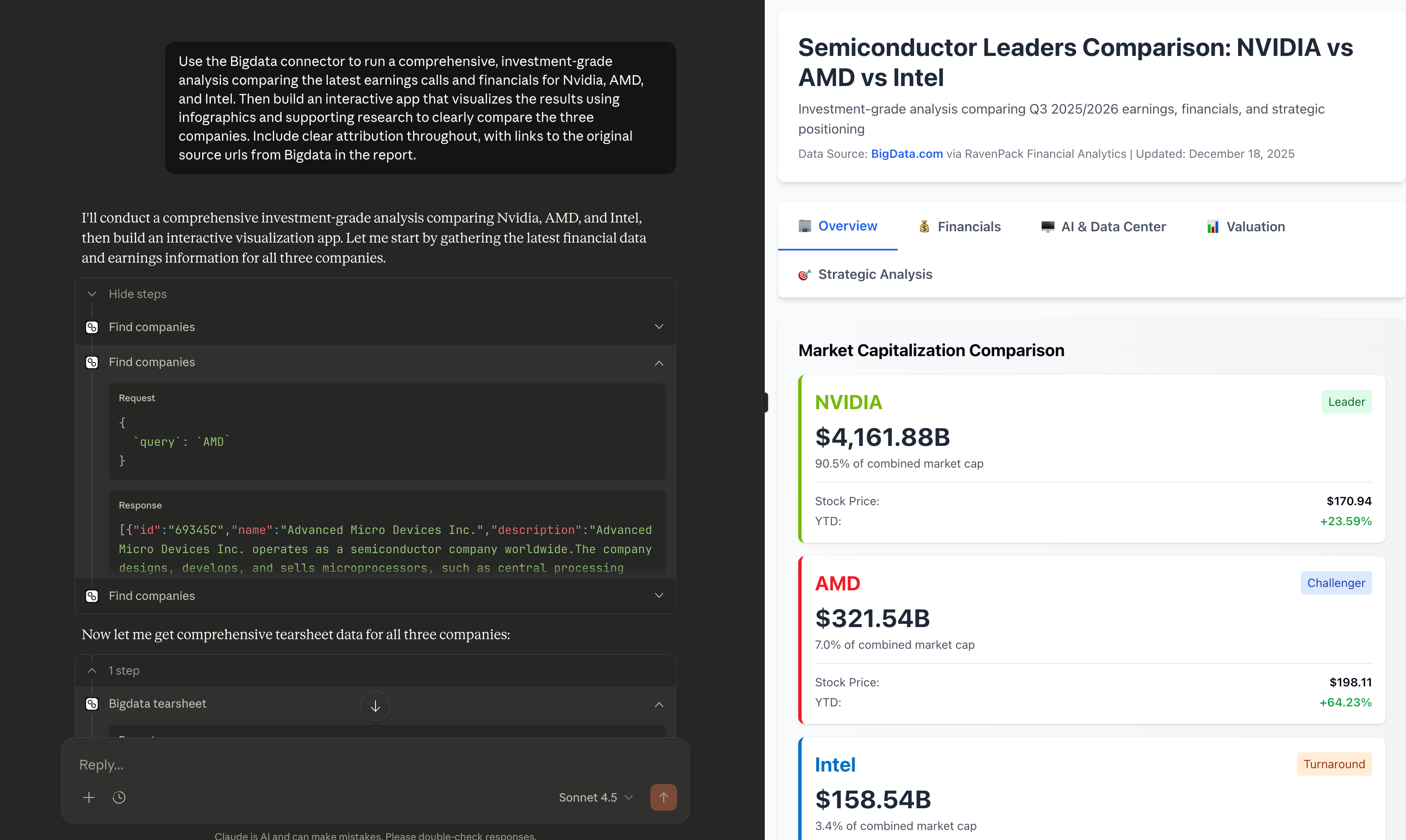

Ultimately, it's about bringing sophisticated agentic workflows, premium content, and 20+ years of financial intelligence infrastructure directly into Claude, ChatGPT, Copilot, or any MCP-enabled platform. We’re turning the AI agentic systems into super agents for investment research. We want to provide ease of access to our solutions and supercharge the systems you’ve already put in place.

The intelligence that makes super Agents possible

Connect Bigdata.com via MCP and watch generic LLMs transform into financial analysts. Here's what powers that transformation:

Search: making sense of billions of documents

Financial decisions live in unstructured data such as earnings call transcripts, SEC filings, analyst reports, news articles. Bigdata.com's Search delivers high recall high precision retrieval across this entire universe of enriched financial content. When an analyst asks about supply chain risks, the system understands context: which companies, which time periods, which business segments actually matter. It connects the dots between a supplier's warning in February and a manufacturer's revised guidance in May because it understands the relationships, not just the words.

Structured data: the numbers that back the narrative

Stories need numbers. Structured Data tooling delivers clean, point-in-time accurate financials: earnings metrics, balance sheet data, valuations, sentiment indicators, coverage estimates, and earnings calendars. When an agent needs to correlate what management said with what the balance sheet shows, the data is already connected and entity-linked — no manual reconciliation required and better yet no attempt to “search” for it. It's already structured so why try to find it in the unstructured? You shouldn’t

Knowledge Graph: the context engine

The RavenPack Knowledge Graph is the backbone that connects millions of data points across global finance - entities, events, corporate structures, temporal sequences - with complete transparency and traceability. Using modern linguistics technology, the knowledge graph analyzes millions of documents from thousands of sources, including both public and private content, to isolate risk signals that enhance your decision-making processes.

Creating and maintaining a vast knowledge graph of information about the real-world is a challenge. RavenPack’s Knowledge Graph allows you to focus on solving the real problems in your domain, rather than building your own solution by providing a knowledge graph as central infrastructure for your organization.

How it works together

An analyst asks Claude: "Analyze Tesla's Q3 earnings performance versus analyst expectations, and assess how supply chain mentions compare to their top 3 competitors over the past 6 months."

The agent searches transcripts for supply chain commentary across Tesla, GM, Ford, and Rivian, pulls structured earnings data to compare actual results against consensus estimates, maps entity relationships through the Knowledge Graph to identify which suppliers and components are being discussed, and synthesizes findings into a sourced report showing both quantitative performance gaps and qualitative strategic positioning. Minutes, not hours. Grounded, not guessed.

The premium data foundation

What makes this intelligence reliable? The data foundation underneath.

Bigdata.com powered agents access premium financial content that represents 20+ years of technological innovation: point-in-time datasets covering an unmatched universe of financial events, companies, executives, and products designed to capture insights that move markets. The content layer includes more than 10,000 premium news sources and more than 12 million entities tracked in real-time.

This is our differentiator. Generic LLMs can process language, but they can't access the depth of licensed financial content that institutional analysis requires. When a Bigdata.com agent retrieves an earnings transcript, it's accessing sentiment-scored, entity-linked, temporally aware content that connects to fundamentals, news flow, and relationship networks.

Zero code, zero friction

Traditional API integration requires engineering effort and ongoing maintenance. MCP requires a five-minute OAuth configuration.

For existing Bigdata.com customers, this eliminates deployment friction. Teams already paying for premium financial intelligence can now access it conversationally - without waiting for engineering resources. For prospects, MCP removes the integration tax entirely. Configure once, and every user gains immediate access to decades of financial intelligence infrastructure.

The future of financial intelligence isn't about building more integrations or forcing teams onto new platforms. It's about empowering agents, with premium data, and 20+ years of financial infrastructure directly in the platforms where teams already work with zero code, zero friction, and complete traceability.

How to get started

Bigdata.com MCP is available now for existing API customers, trial users, and qualified prospects with technical MCP configuration capabilities.

Ready to bring financial intelligence to your AI workflows?

Explore technical documentation or book a call with our team at sales@bigdata.com