Risk Analyzer: identifying corporate exposure to US-China trade tariffs

July 2025•Bigdata.com team

Learn how to mine news datasets to dynamically identify and rank companies based on real trade and geopolitical risk exposure, beyond static supply chain or sector mappings.

Traditional risk assessments fail to capture dynamic and emergent threats from geopolitical, macroeconomic, and policy shifts. Static models lack context, and manual research is fragmented and slow. With Bigdata.com’s generative AI research tools, risk exposure analysis can now be performed systematically and at scale.

What used to take weeks of manual scenario mapping, document review, and exposure scoring can now be accomplished in minutes.

Use case example: tracking corporate exposure to new U.S. import tariffs on China

Traditional models struggle to detect company exposure to sudden policy risks like “New US Import Tariffs on China.” This use case shows how to mine news datasets to dynamically identify and rank companies based on true exposure to specific trade and geopolitical risk channels, without relying solely on static supply chain or sector mappings.

Why it matters

Geopolitical and economic risks are constantly reshaping markets, but identifying which companies are truly exposed is still slow and manual. AI-driven risk screening automates this process and helps you to quickly uncover vulnerabilities and make better portfolio and strategic decisions.

This use case shows how to:

- Define a risk scenario (e.g. new US import tariffs against China)

- Generate a taxonomy of risk factors and sub-scenarios (e.g. supply chain risks, foreign market access risks)

- Build a hybrid system to retrieve news documents with Bigdata Search API

- Label relevant chunks using LLMs

- Score and rank companies by exposure

Learn how the Risk Analyzer delivers insights in our step-by-step cookbook. .

Workflow summary with Bigdata API

Define your risk and scope. Start by setting the main theme (New US Import Tariffs on China), universe (Top 100 US companies), time window (last quarter), and analysis model (GPT-4o-mini).

Build a dynamic risk taxonomy. Instead of relying on generic risk tags, generate a structured taxonomy of risk factors and sub-scenarios. For example:

- Trade relations risks from tariff retaliation

- Supply chain disruptions from manufacturing shifts

- Market access risks affecting overseas sales

- Intellectual property risks linked to enforcement tensions

Search news with hybrid retrieval. Comb through massive unstructured datasets using a blend of keyword, semantic, and cross-encoder search to surface the most relevant evidence of corporate exposure to the defined US-China trade risks.

Validate risk relevance with LLMs. An LLM then acts as your analyst, confirming whether each mention truly reflects exposure to the risk sub-scenarios, filtering out irrelevant or generic references.

Score and rank exposure. Finally, companies are scored and ranked based on how frequently and materially they are exposed to the defined risks—revealing who is most vulnerable to the scenario.

What emerged

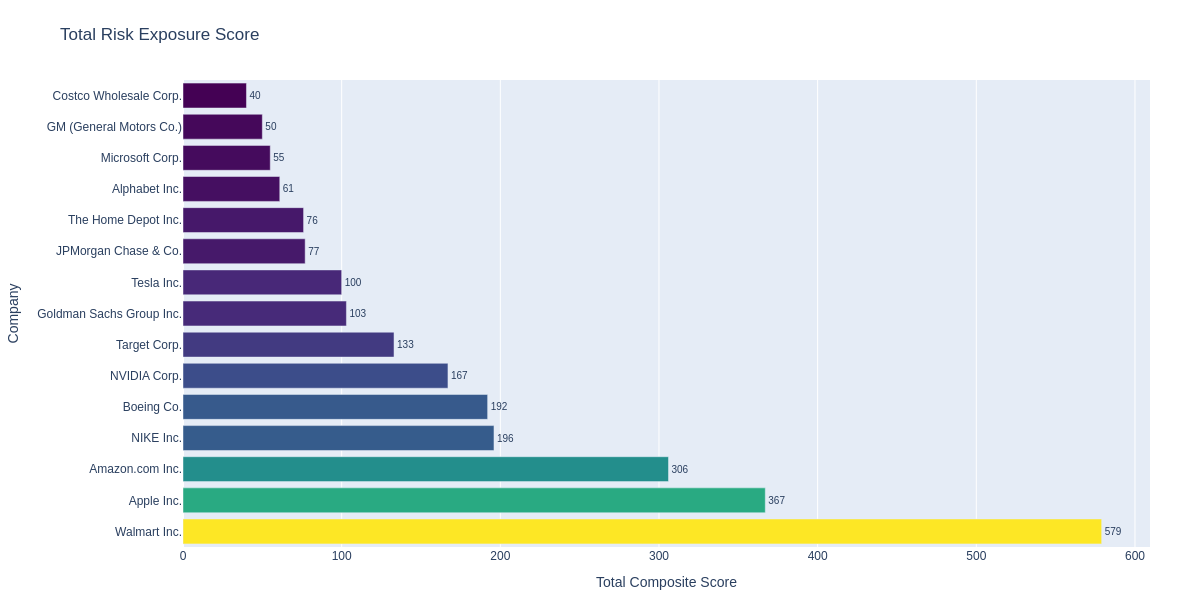

- A ranked list of the top companies exposed to new US import tariffs on China;

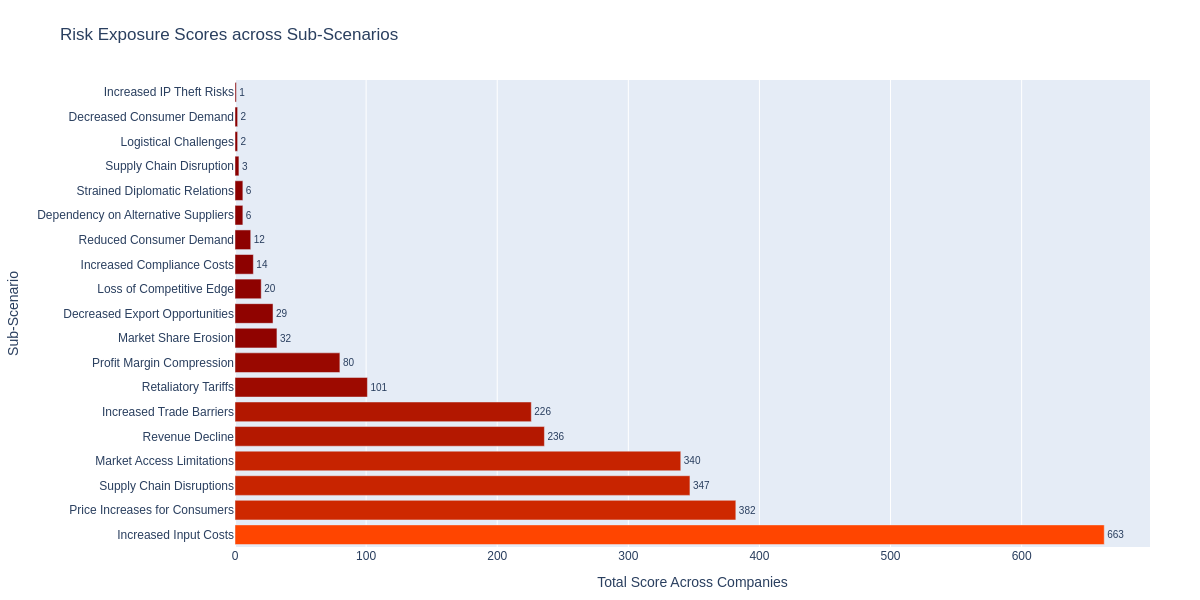

- Sub-scenario level scoring for deeper operational and strategic insights;

- Far greater precision than static supply chain mapping alone.

Good to know

This process is embedded in the Bigdata Research Tools library and has powered the Thematic Watchlists focusing on geopolitical risk and supply chain vulnerability available in Bigdata.com.

Ideal for

Risk analysts, portfolio managers, strategy teams, ESG and geopolitical research analysts, and investment professionals assessing exposure to emerging risks.

Practical applications

- Risk surveillance at scale: Move from headlines to exposure maps in minutes

- Portfolio risk management: Identify and mitigate concentrated exposures to policy or geopolitical shocks

- Strategy and supply chain planning: Understand operational risks and inform diversification decisions

- Board and risk committee prep: Provide structured, data-driven exposure insights for decision-making

Technical stack

- Bigdata API for document access and hybrid search

- bigdata-research-tools for taxonomy creation, scalable search, and labeling workflows

- LLMs (e.g. GPT-4o-mini) to validate content relevance and assign exposure categories

- Vector storage for low-latency retrieval

Unlike traditional risk models that rely only on static mappings, this method uses generative AI to create adaptive risk taxonomies and validate them with LLM labeling, ensuring higher precision and contextual relevance.

Ready to build your own risk exposure analyses?

Explore our Github cookbooks repository and deploy scalable risk analyzers today.