How Bigdata.com turbocharges ideation

January 2025•Aakarsh Ramchandani, Chief Strategy Officer

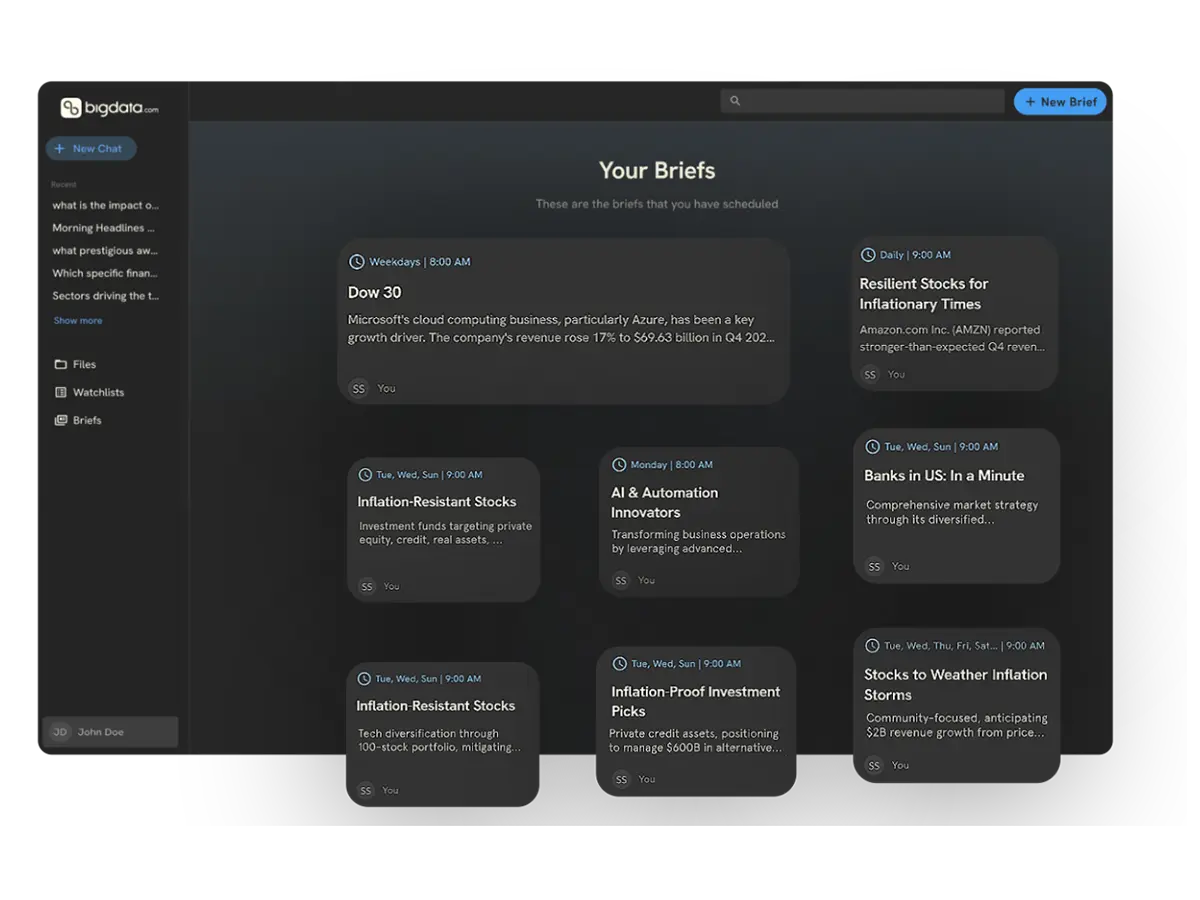

Discover how Bigdata.com revolutionizes investment research and thematic ideation with AI-powered tools that identify trends, generate insights, and amplify analyst capabilities.

I often get asked this question:

How does Bigdata.com help with ideation?

What a great question! This is what we've been designing this system for: qualitative screening, on steroids. A world where you can screen for your thoughts and get targeted answers and ideas to explore.

My team loved this idea even more than me, and I woke up today to this podcast sitting in my inbox. It's about "What is Wall Street saying about energy demand in Data Centers?". Have a listen...

Our solutions engineering team was playing around with Bigdata.com's API and NotebookLM and built this in 2 minutes! This was such a fun listen on my morning commute.

I follow this theme, I've read numerous research reports, but listening to it summarized like this, quotes from CEOs, interesting highlights, all delivered to me via a morning podcast genuinely got me excited.

Did you ever think this would be possible just a year ago? Are we now officially in the world of Retrieve -> Augment -> Generate Text -> Generate Audio -> Generate Video?

RAG is dead. Long live RAGGG?

I jest, but it did bring up some thoughts around this critical ideation workflow, and its something that is truly resonating with our clients.

What is Qualitative Screening?

Well, one of the most compelling applications of AI in investment research lies in its ability to process vast datasets and unearth insights that would be virtually impossible for human analysts to uncover manually. We help our clients run 100s of thousands of searches to identify trends and ideas around trends. We do this at scale, with real-time data, and help them identify opportunities for risk AND alpha.

Just think about the podcast you just listened to above... We are looking to analyze the impact of energy demand on data centers. By sifting through a massive volume of earnings call transcripts, the platform identified a diverse array of companies across the supply chain that were discussing this specific theme.

If you follow this theme, what stuck to me in our report was that we didn't just find your usual suspects: semiconductor, utilities & renewable energy companies. It also included also REITs, electrical substation companies, semiconductors equipment companies, energy services companies etc etc. This was a whole new way to explore these theme in detail and tie to investable securities.

My own investment process is as follows: I track narratives, run my screens for those narratives, filter for some unusual sectors that show up, and then do a deeper dive into those securities. Here are some interesting ideas I found on this topic:

SmartOptics AG talking about energy demand in Data Centers

Why? Let's ask Bigdata.com:

Validating a thematic idea using Bigdata.com

I would never have connected the dots there. Lets look at another outlier: World Kinect Corp. Yes, I asked Bigdata.com again:

Why did World Kinect Corp. talk about energy demand in data centers? Turns out, their CEO Michael has a perfectly good reason for it. His business provides Energy Fulfillment and Related Services! And he easily wins the award for the best quote of the day: There's no GLP semaglutide solution for energy consumption.

These examples are small, but illustrate how AI can expand analysts' horizons, illuminating connections and dependencies that might otherwise go unnoticed. It can do it faster, and will give you more ideas to act on than you've ever had before.

What should you take away from this?

A few weeks ago, I was fascinated by this paper written by Aidan Toner-Rodgers. Aidan makes the case that AI is massively increasing the velocity AND diversity of new compounds in material science. Verbatim, he says:

AI automates 57% of idea-generation tasks, reallocating scientists to new task of evaluating model-produced discoveries

I'm seeing this play out in Finance as well. And its also led me to another conclusion for anyone working in Finance: AI is NOT coming for your job... It will however change the nature of your work. You'll soon learn that it is an invaluable tool, empowering you with unprecedented capabilities to analyze a world where the number of "tokens" you're tasked with evaluating is increasing at an exponential pace.

I don't see LLM's as a replacement for human judgement, at least not yet. The most successful investors will be those who can effectively harness the power of AI while retaining their critical thinking skills.

Tools like Bigdata.com can handle the heavy lifting of finding you the signal from the noise, but it is ultimately up to human analysts to interpret the results, formulate investment theses, and make strategic decisions. I suspect very soon, it will likely become an extension of the analyst's mind, empowering them to see further and think more deeply.

We're entering an era of idea abundance.

I think we can be your ideation factory.

Related articles

8 essential datasets every investor needs in 2025

When AI meets financial journalism: a new era of market intelligence