Bigdata.com cheat sheet for earnings season

April 2025•Bigdata.com team

How to use watchlists and financial datasets to make the most of earnings season.

Earnings season is here and it can be overwhelming, but having the right tools makes it easier to stay informed. Whether you're tracking companies, analyzing trends, or watching real-time reactions, these tips can help you stay ahead of the game.

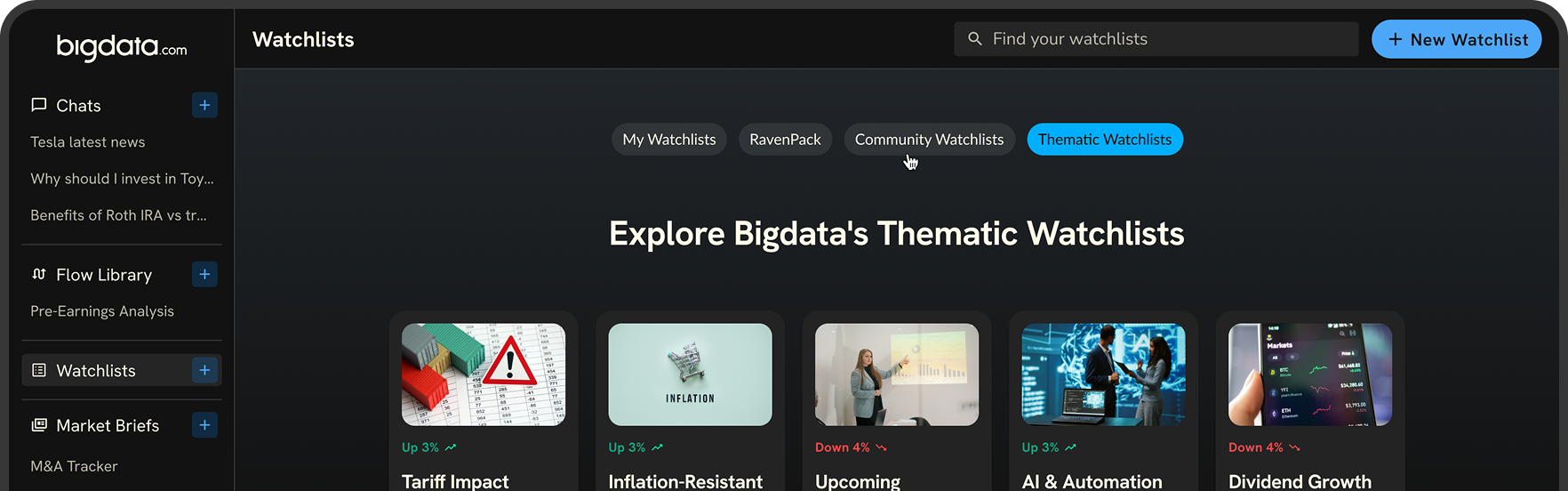

1. How to set up a stock watchlist for earnings season

Start by creating a stock watchlist for the companies you're following in Bigdata.com. Enter their ticker symbols or names, and you'll have a focused list ready. This allows you to quickly analyze key financial trends. Here are two useful queries:

- @estimates – "What was the EPS trend for my portfolio over the last 4 quarters?"

- @news – "How did stock prices in my portfolio react to earnings reports over the past year?"

What is EPS? EPS (Earnings Per Share) measures how much profit a company makes per share of stock. It's calculated by dividing net income by total shares. A higher EPS generally indicates better profitability.

2. Conduct a pre-earnings stock analysis

Use Bigdata.com's specific financial datasets to review past earnings performance and spot trends before reports come out. Try these prompts:

- @pricing – "Plot Apple's price with 50-day and 200-day moving averages over the last 4 quarters."

- @sentiment – "Plot analyst rating sentiment and earnings sentiment for Tesla over the last 6 months."

What are moving averages? Moving averages help smooth out price data over a set period to identify trends. The 50-day moving average is a short-term indicator that shows recent price trends, while the 200-day moving average is a long-term trend indicator. Comparing both helps traders assess momentum and potential reversals.

What is Analyst sentiment? Analyst sentiment reflects the collective outlook of financial analysts regarding a stock. It is based on ratings, earnings forecasts, and recommendations (buy, hold, or sell), providing an overview of market confidence in a company's future performance.

What is Earnings Sentiment? Earnings sentiment analyzes the language used in earnings reports and calls to gauge management's confidence and market reaction. Positive or negative sentiment can influence investor behavior and stock movements.

These insights help identify patterns in stock performance and prepare for potential market movements.

3. Track real-time market reactions on earnings day

Stock prices often experience volatility on earnings day. Stay ahead by monitoring real-time reactions using queries like:

- @earnings-calls – "Identify changes in Amazon's guidance or management's tone that could indicate surprises, like revising revenue forecasts over the last 6 months."

What is guidance? In this context, guidance refers to the forward-looking information or projections provided by a company about its expected financial performance, such as revenue forecasts, earnings predictions, or other key metrics. It is often shared during earnings calls or in press releases to help investors understand the company's expectations for future performance.

Remember, the key to success during this time is not just about reacting to reports, but proactively analyzing trends and making informed decisions before and after earnings releases.

Happy researching!

The only research API designed for Wall Street

BigData.com delivers seamless tech integration for CTOs and market intelligence-driven analytics for Quants.